The FRAML Fusion: Merging Minds and Methods to Outsmart Financial Criminals

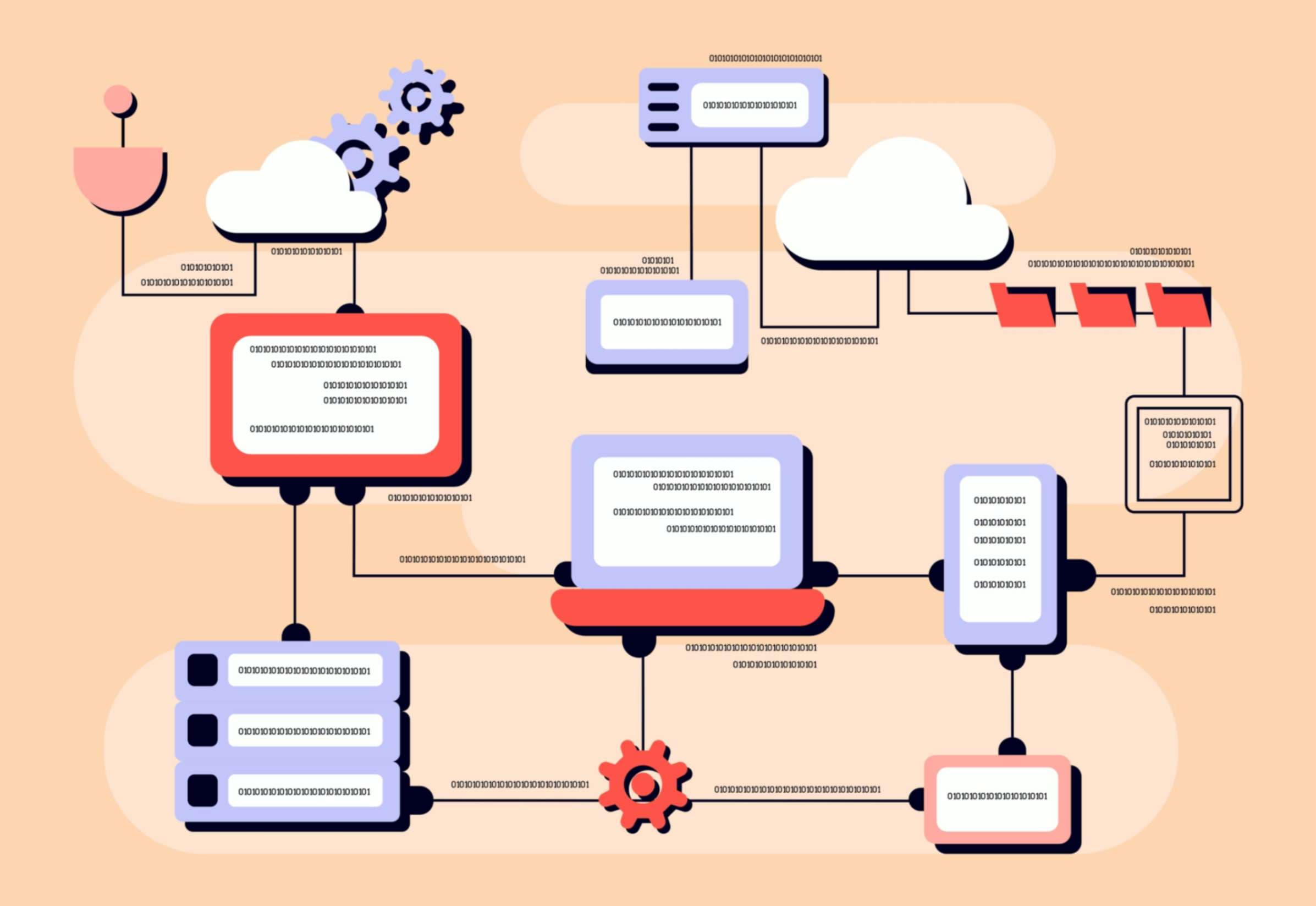

The integration of Fraud and Anti-Money Laundering (AML) operations into a unified framework, commonly referred to as FRAML, marks a significant shift in the approach to combating financial crimes. Traditionally managed as distinct domains, the convergence of fraud and AML systems is a response to the evolving complexity and interconnected nature of financial crimes. This strategic alignment is driven by the necessity for a more comprehensive and effective response to detect and prevent illicit activities that have seen a notable increase in recent years.

According to the Federal Bureau of Investigation, the fraud space has grown by 23% year over year. This alarming rise highlights the urgency for more robust mechanisms to safeguard financial systems. The siloed approach previously employed has proven inadequate in addressing the sophisticated techniques employed by criminals who often exploit the gaps between fraud detection and AML measures (FBI, 2022).

The rationale for integrating fraud and AML functions into FRAML is rooted in the shared objectives and overlapping strategies of these disciplines. Both areas aim to identify irregular patterns and potential threats within financial systems, yet they focus on different aspects of financial crimes. Fraud detection primarily focuses on identifying and preventing wrongful or criminal deception intended to result in financial or personal gain. In contrast, AML efforts are directed towards preventing money laundering, which involves disguising the origins of illegally obtained money. By merging these functions, organizations can leverage shared intelligence and resources, leading to more effective detection and prevention strategies.

One of the key benefits of FRAML is the enhanced ability to detect anomalies and red flags across a broader spectrum of financial activities. This holistic view allows for the early detection of sophisticated schemes that may span multiple financial channels and jurisdictions. For instance, a unified FRAML approach can link seemingly unrelated transactions that could be overlooked if analyzed in isolation. This capability is particularly crucial in a globalized economy where financial transactions are not confined to national borders (Smith and Jones, 2021).

Furthermore, the integration of these systems facilitates better communication and information sharing among d

Read-Only

$3.99/month

- ✓ Unlimited article access

- ✓ Profile setup & commenting

- ✓ Newsletter

Essential

$6.99/month

- ✓ All Read-Only features

- ✓ Connect with subscribers

- ✓ Private messaging

- ✓ Access to CityGov AI

- ✓ 5 submissions, 2 publications

Premium

$9.99/month

- ✓ All Essential features

- 3 publications

- ✓ Library function access

- ✓ Spotlight feature

- ✓ Expert verification

- ✓ Early access to new features

More from 2 Topics

Explore related articles on similar topics