Operational Delays, Real Dollars: Managing Time as a Strategic Asset

Many operational leaders miss the financial significance of time delays in routine processes. Unresolved tasks that linger often carry hidden costs. These costs might not appear immediately in a line-item budget but show up through emergency staffing, lost efficiency, or increased contractor fees. By treating time as a measurable financial input, leaders can better predict where inefficiencies will translate into higher expenses. For example, a delayed permit approval can lead to project slowdowns, which might trigger liquidated damages or require overtime to meet deadlines. Connecting task aging metrics with cost implications can help prioritize interventions that have the highest return on effort.

This approach is particularly useful in high-volume environments like code enforcement, licensing, or procurement. Agencies that track not just volume but also cycle times tend to identify bottlenecks faster and allocate resources more intelligently. The City of Phoenix, for instance, implemented a performance dashboard that tracks service request aging and ties it to cost metrics, allowing managers to shift resources preemptively before delays become expensive problems (Government Finance Officers Association 2022)1. This kind of data-driven management turns time from an abstract complaint into a concrete, quantifiable variable that supports better financial and operational decisions.

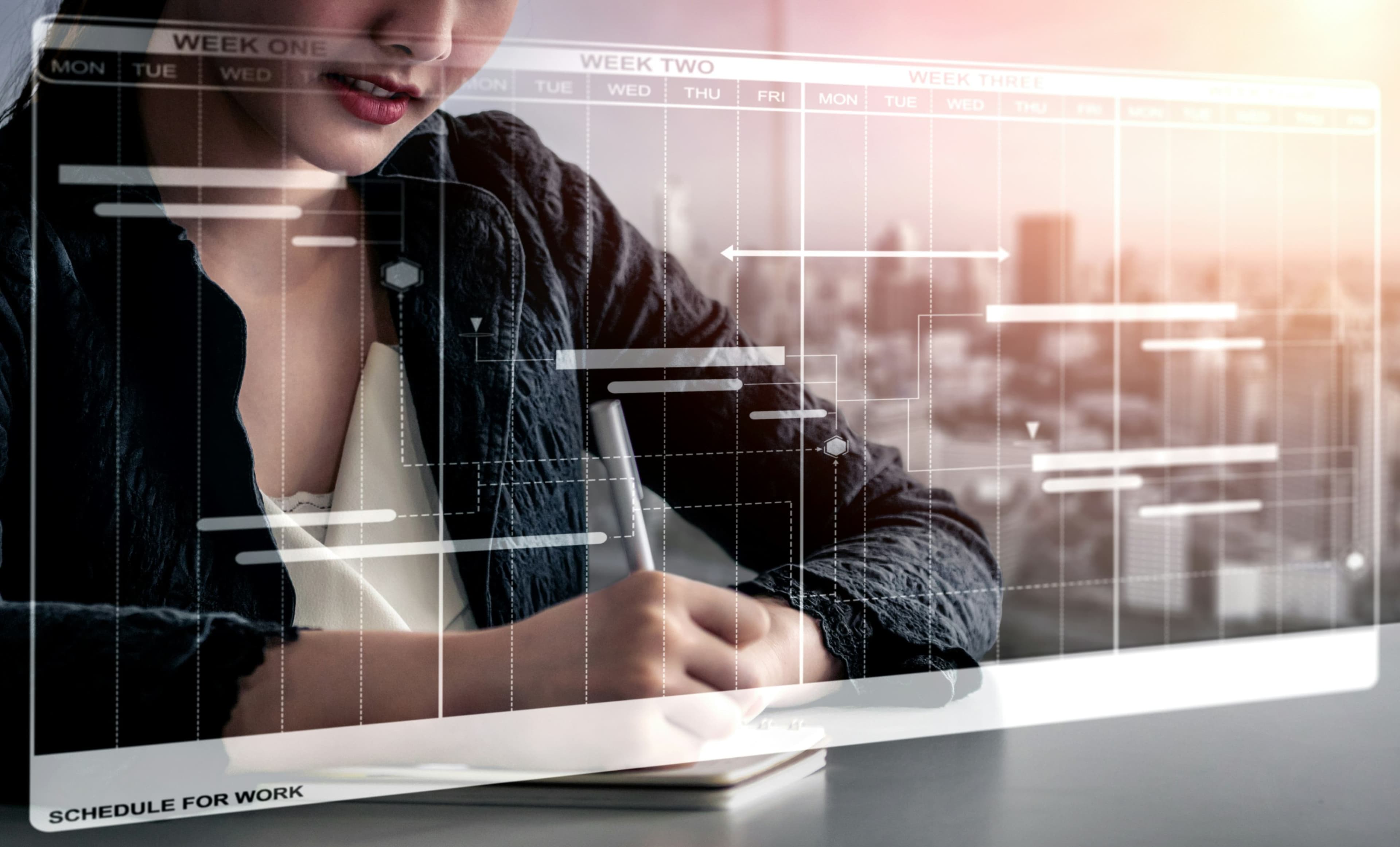

Integrating Performance Data with Budget Strategy

One common disconnect in government operations is the separation between budget planning and performance management. Often, department heads advocate for more funding without demonstrating how their use of time and resources aligns with strategic outcomes. By embedding performance data into the budgeting process, agencies can make more credible cases for investments or reallocations. A practical technique is to link outcome-based metrics, like average resolution time or backlog clearance rate, to specific budget line items. That way, when performance improves, the financial impact can be tracked and validated.

For example, the City of Baltimore's Outcome Budgeting initiative requires departments to justify expenditures based on measurable results, not just historical allocations (City of Baltimore 2021)2. This encourages departments to analyze how their workflows and timelines affect budget utilization. If a department can demonstrate that reducing permit processing time by 20 percent led to a measurable increase in fee revenue or avoided overtime, it strengthens the case for sustained or expanded funding. This method also fosters a culture of accountability and continuous improvement, where financial and operational performance are interlinked rather than siloed.

Cross-Functional Collaboration and Financial Efficiency

Another area where management and finance intersect is in cross-functional coordination. Delays and cost overruns often result not from individual departments failing, but from poor handoffs between them. If a procurement team cannot process contracts quickly due to incomplete scopes from the requesting department, the entire project timeline stretches, and costs rise. Addressing such inefficiencies requires more than internal reforms; it demands structured collaboration across units.

Structured interdepartmental meetings focused on process timelines, not just budget compliance, can uncover chronic lags with high financial impacts. San Diego County adopted a Lean Six Sigma approach to such coordination, especially in procurement and capital project planning, which led to 25 percent faster turnaround times and significant cost avoidance (San Diego County 2020)3. The key was not to audit each department in isolation but to treat the workflow as a shared asset whose efficiency or delay had mutual budget consequences. When managers understand that a one-day delay in one unit causes a five-day delay downstream, the incentive to collaborate becomes clearer and more financially urgent.

Using Technology to Align Time, Output, and Cost

Modern data platforms make it easier to align operational timelines with financial data. Tools like enterprise resource planning (ERP) systems or performance dashboards can reveal patterns that were previously buried in spreadsheets or anecdotal experience. However, technology only adds value when managers are trained to interpret and act on the data. It's not enough to install software - staff must be engaged in setting thresholds, flagging delays, and linking those delays to specific budget outcomes.

For example, Arlington County, Virginia, integrated its ERP system with performance dashboards that highlight when project milestones are slipping and automatically estimate cost overruns based on historical data (ICMA 2021)4. This proactive alerting allows managers to intervene early rather than react after financial damage has occurred. The system supports not just transparency but agility - letting leadership reallocate funds or adjust priorities based on real-time insights rather than waiting for quarterly reviews. When used properly, technology becomes not just a reporting tool but a mechanism for daily financial control rooted in operational awareness.

Leadership Practices That Strengthen Financial Outcomes

Ultimately, improving financial health through better management practices requires leadership that treats time, data, and collaboration as strategic assets. Leaders who regularly review time-based performance indicators, convene cross-functional problem-solving sessions, and insist on connecting results to budgets build cultures that are both efficient and fiscally responsible. This shift does not require large investments, but it does demand consistency and clarity in expectations.

For instance, setting clear performance expectations tied to financial metrics in employee evaluations can reinforce the importance of timely task completion. When staff know that delays not only affect customer satisfaction but also trigger cost implications, they are more likely to prioritize work accordingly. Leadership must model this behavior by using time-based data during budget discussions, performance reviews, and operational planning sessions. Consistent emphasis from the top helps embed these habits into the organization's daily routines and long-term strategy.

Bibliography

Government Finance Officers Association. “Using Performance Data to Improve Cost Efficiency.” GFOA Best Practices, 2022. https://www.gfoa.org/materials/performance-data.

City of Baltimore. “Outcome Budgeting: Fiscal 2021 Budget Book.” Baltimore City Department of Finance, 2021. https://bbmr.baltimorecity.gov/sites/default/files/FY21%20Adopted%20Budget%20Book.pdf.

San Diego County. “Operational Excellence Through Lean Six Sigma.” County of San Diego Annual Report, 2020. https://www.sandiegocounty.gov/content/sdc/annual-report-2020/lean-six-sigma.html.

International City/County Management Association (ICMA). “Data-Driven Management in Arlington County.” ICMA Case Studies, 2021. https://icma.org/case-studies/arlington-county-data-management.

More from Management and Finance

Explore related articles on similar topics